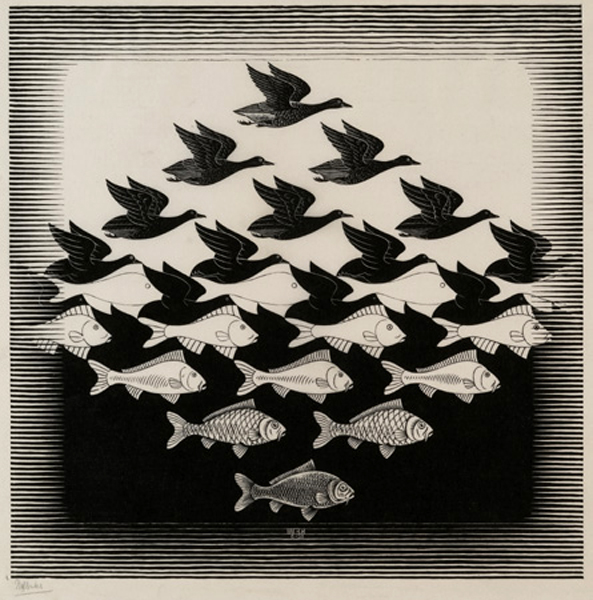

| It's not a fair fight, ref! Source |

However, one of the tests of an investment approach is how stable it is: whether you can go off on holiday for a couple of weeks and not face financial ruin while you are away. Is your portfolio open to major market or security risks that actually need your constant attention?

I have written before about our family's choice of cruising for a holiday. When we set off for the Arctic (!) this year, I don't intend to be managing our portfolio of ISAs and SIPPs - in fact not even looking at them for a couple of weeks. So, am I cruisin' for a bruisin'? Will the market steam-roller me?