|

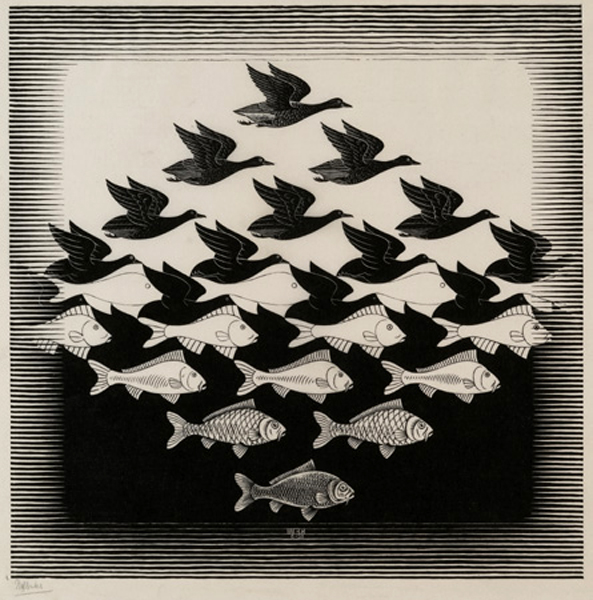

| Neither fish nor fowl Source |

The answer, I would suggest, is that new situations require a new approach: what worked last year may not work now.

However, as I have tried to describe in previous posts, our investment approach is probably based on our own deep-rooted behavioural traits that we would almost certainly find difficult to change. So the most practical response to the new market conditions may be a modification of approach – the style may be broadly the same but using different tactics; it may look similar but it will be a different animal.

My own investment approach is - fairly obviously - based on buying stock market securities that generate income. I use the yield as a guide within an asset class, as well as when comparing different asset classes, for what is out of favour with the market and then try to check the fundamentals to make sure my investment will not disappear in a puff of smoke.

Like most investors, I look for confirmation of my own biases. Fortunately there is quite a lot of this in relation to dividend share investing - although one piece of research suggests that perversely the high total returns may be in spite of the high yields and are more likely due to the 'value' characteristics of many of these high-yield shares.

The particular recent ‘success’ of my own strategy was based on a decision around two years ago to increase the proportion of high-yield fixed-income securities in my portfolio to around 50% as well as holding onto my high-yield dividend shares. That worked out well with a 30% total return in FY 2012/13.

But now the market conditions have changed (again), with May 2013 marking a 'high water' point for the portfolio value. Although I am by nature a ‘buy and hold’ investor, I have been taking profits – particularly from the fixed-income part of the portfolio (selling corporate bonds in Enterprise Inns, Santander, Standard Chartered, Lloyds and Halifax/Lloyds) plus a couple of opportunistic share sales.

Now I look at the list again, I realise what a strategic rebalancing this has been.

These sales have thrown up a lot of cash and, unwilling to leave cash idle, I have been spreading out the sale proceeds in:

- A range of diversified international income-oriented ETFs, with lower yields but hopefully more resilient for the coming volatility and requiring less attention from me

- More high-yield dividend shares with a high international component (including a gold mine!)

However, the rollercoaster ride of the markets has continued over the past couple of months resulting in a flat performance since the beginning of the 2013/14 financial year. Perhaps this is the best that I should hope for – I hope that you have done better!

But I am pragmatic enough to know that further changes will probably be required. One direction I am trying is UK commercial property, which will hopefully benefit from an uptick in business confidence. I already hold a little SEGRO (which has disappointed) but my latest purchase is the Standard Life Investments Property Income Trust, which is now my second largest shareholding (after Tullet Prebon). But I am aware that this may be a 'wolf in sheep’s clothing': it has a huge 8% yield but a worryingly low dividend cover.

[Based on an article published earlier in citiwire money]

Update 23/6/13: Very early days, obviously, but SLI is up 7%, making it now my largest dividend share holding by current value.

I am not a financial adviser and the information provided does not constitute financial advice. You should always do your own research on top of what you learn here to ensure that it's right for your specific circumstances.

No comments:

Post a Comment