You may recall that having a chunk of cash in a high-interest but easy-access bank account is part of Level 2 of the DIY Income Investor Income Pyramid. Keeping an 'emergency fund' available to deal with unexpected large expenditure items is good planning - but you want to make sure that the money is working hard and generating as much income as possible. Keeping this 'easy access' account allows you to tie up any further spare cash in a deposit account with - hopefully - an even higher rate of interest (Level 3).

A simple approach to successful personal investing with the goal of generating a growing income from a portfolio including cash savings, shares, corporate bonds and government-backed investments, using online savings and brokerage accounts and shielding your investments from tax wherever possible. Making money since 2011

Thursday 28 April 2011

Tuesday 26 April 2011

Student Loan Calculator (UK)

One of the major expenditure items in my financial plan is sending kids to University. In a previous post, I highlighted how the new UK student loan was more like a student tax. I have now added a spreadsheet that shows how much students will have to repay. It makes for scary reading!

Wednesday 20 April 2011

10 Resolutions for the New Financial Year

The start of a new financial year provides a number of opportunities to develop or fine-tune your savings and investments so it's a good time to review your strategy and approach. Here are my 10 financial resolutions for the next tax year.

Wednesday 13 April 2011

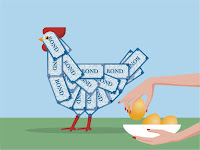

6 Reasons to Include Bonds in Your Portfolio

The DIY Income Investor approach suggests owning bonds - both bonds issued by governments and by banks and other companies - in the following ways:

- Exchange Traded Funds (ETF) tracking government or corporate bonds : Level 4 of the Income Pyramid

- Directly-held government bonds: Level 5

- Directly-held corporate bonds: Level 7

Monday 11 April 2011

5 Steps to Buy a Reliable High-Yield Dividend Share

Level 6 of the DIY Income Investor Income Pyramid consists of high-yield shares in a High Yield Portfolio (HYP). For more experienced investors this will be a key tool in hopefully gaining income and capital growth.

Today we'll look in more detail at how to identify a suitable HYP share in 5 easy steps.

Monday 4 April 2011

A Junior ISA to Fund University Fees? (UK)

One of the costs for UK parents must now budget for is putting a child through university. This is a cost that is growing rapidly - several universities have announced that they intend to charge £9,000 a year in tuition fees; living costs must also be taken into account.

Also, recent changes to the student loans arrangements have been made - but these result in more of a student tax than a student loan.

Would it be possible to use a Junior ISAs to save for university costs?

Also, recent changes to the student loans arrangements have been made - but these result in more of a student tax than a student loan.

Would it be possible to use a Junior ISAs to save for university costs?

Save £10 a day - it's worth £70,000 (or more)!

How can I claim that such a relatively modest daily saving will result in such a large figure?

A fundamental part of the DIY Income Investor approach is to constantly re-appraise (and hopefully reduce) your living costs. This process helps to generate more speed on the Money Snowball - that almost magical process that probably has to be experienced to be fully understood.

Labels:

Money Snowball,

Saving

Subscribe to:

Posts (Atom)