To some extent it could be argued that every investor 'speculates', as the original meaning - from the Latin speculum, mirror - implies reflecting figuratively the future, and specifically that they will get more money that was initially invested.

However, in common usage the distinction is simple but powerful: Investors buy shares of businesses, and prosper over time as the company grows profits. Speculators, on the other hand, trade wiggles on a stock chart, in hopes of selling shares at a higher price to other speculators within a few quarters.

Bear markets, Bogle believes, separate the speculators from the true investors. The typical speculator is three times more interested in the price of a stock than the merits of underlying businesses - and bear markets can shake these speculators out of stocks, sometimes forever. When you factor in frictional trading costs (and short-term tax rates in the US), it's extremely difficult for speculators to make long-term money by trying to time their way into and out of bull and bear markets.

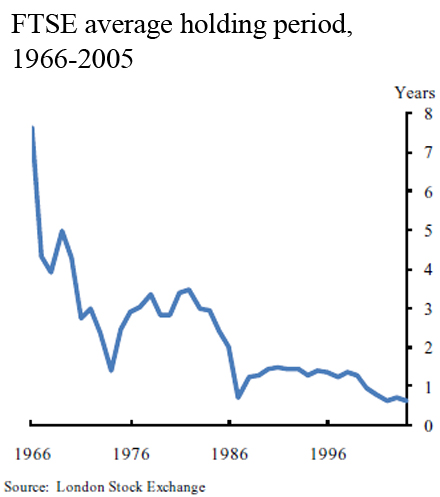

The following table (from Citywire Money's Smart Investor) shows the average holding period for FTSE 100 shares from 1966 to the present day. This has fallen from eight years in 1966 to one year in the mid 1980s and has remained at less than one year for the last 25 years. The causes of this fall in holding duration (the article speculates) could range from easier access to the stock market due to the internet, to more private individuals looking after their own share dealing affairs as a result of the London Big Bang. However, it is clear that the buyers of shares today seem to be less patient than their counterparts from the '60s, '70s and early '80s.

My own feeling is that the increased (and now widespread) use of trading 'bots' by the institutions is mainly to blame.

By now you should be aware that the DIY Income Investor is much more of an Investor than a Speculator. During the past few months, the capital value of my investments has fallen - not surprisingly - but the income has increased, primarily due to increased dividends.

That is not to say, of course, that sometimes there is a nice profit to be taken - but that is the exception.

Having said all that, I am not a great fan of Mr Bogle's (or anyone's) index funds and I don't recommend them for a DIY Income Investor. I prefer to get regular income rather than float up and down on market sentiment.

Well - how about you: are you an Investor or a Speculator?

I am not a financial advisor and the information provided does not constitute financial advice. You should always do your own research on top of what you learn here to ensure that it's right for your specific circumstances.

It has taken me 10 years to move out of my naive speculative (gambling) approach to the income investment approach. I have to say that being in income investor so far gives me far less to worry about, it's a more passive approach - the last few months would have given me sleepless nights if I'd been speculating.

ReplyDeleteAs a younger investor (possibly) I like a bit of speculation in the pot - now about 80% of my investing is pretty safe but I do also feel a bit of speculation is required. Faint heart never won fair lady and all that.

ReplyDelete@Anonymous

ReplyDeleteI still speculate a little - e.g. CW. Why not - as long as you limit the risks.

@David

ReplyDeleteAbsolutely - you have found one of the great advantages of income investing!